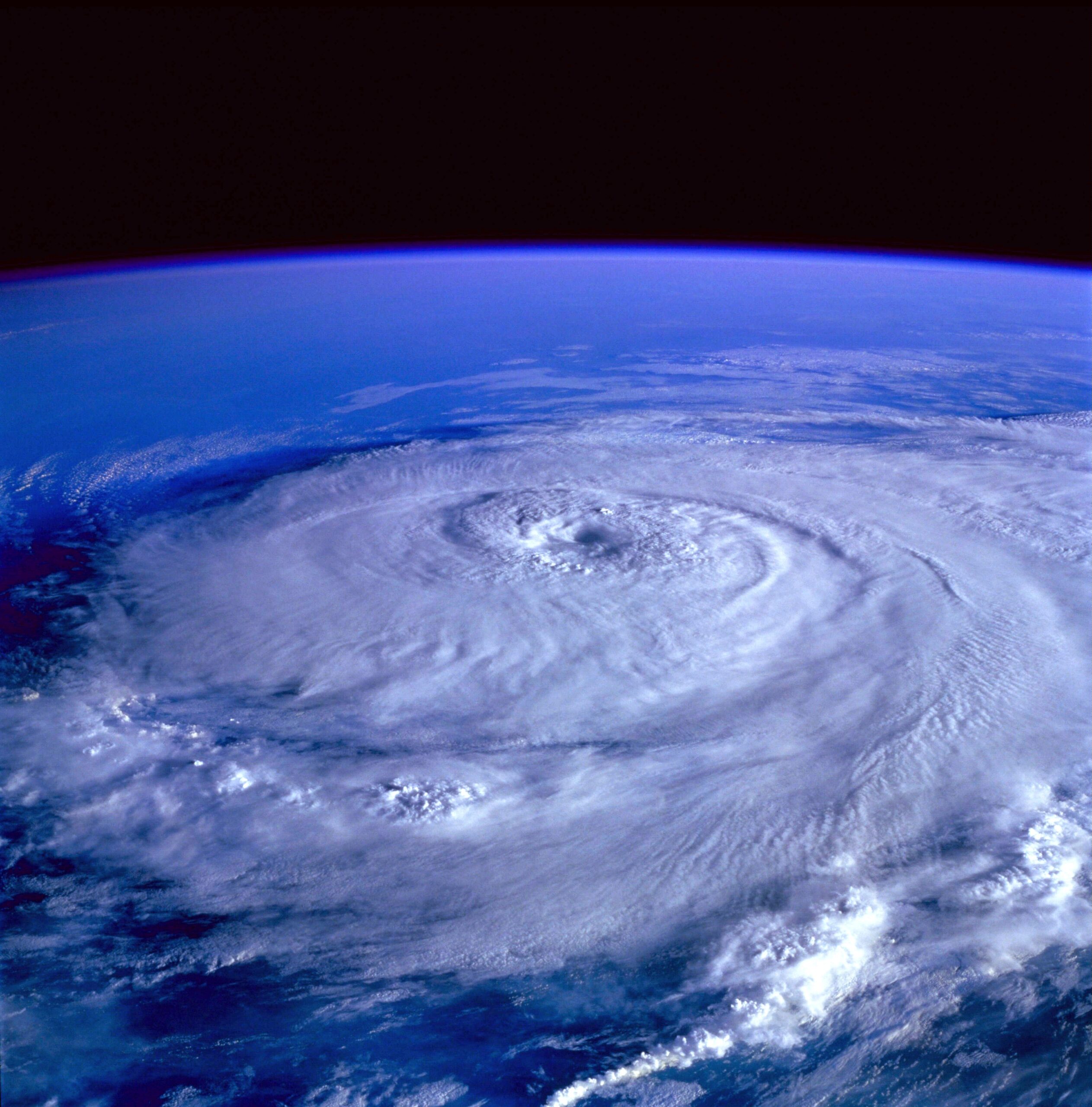

The Cash Flow “Perfect Storm”

Learn about the critical financial components to monitor your cash during the COVID-19 crisis.

If you are like most small businesses today, you are seeing unprecedented obstacles to your cash, from additional or unplanned costs driven by the impact of a “new normal” to increasing the unpredictability of customer behavior and buying patterns. When you add in changes to cash access from the government and bank lines of credit on top of all of this, the suddenness and uncertainty of these changes can cause the “perfect storm” for your businesses’ cash.

In situations like this, your best protection is a higher level of financial vigilance, which increases the precision of knowing where your cash stands at any given time as well as the ability to identify ways to stay ahead of the factors most likely to impact its balance.

Even the best small businesses typically monitor their cash on a monthly or quarterly basis. Immediately increasing the frequency in which you evaluate your cash, its critical components, and their impact on each other will improve your ability to proactively make decisions that can stabilize and improve your business’ solvency and liquidity

Three critical financial components to monitor your cash:

- Revenue and Gross Profit Trends

- Accounts Receivable and Accounts Payable Aging

- Cash balance fluctuations

Revenue and Gross Profit Trends

Monitoring revenue and gross profit on anything greater than a weekly basis during this period of instability has the potential to mask a brewing problem that can quickly sabotage your cash flow. Week-to-week views of client revenue and Gross Profit will help you more precisely track changes and make changes in projections and ultimately more sound decisions on actions required to ensure short and long-term business health and client retention.

AR and AP Aging

Understanding how your accounts receivables and payables are changing on a weekly basis are also critical to knowing which “levers” to pull in order to maintain your negotiating and leveraging ability with those who owe you money as well as those who you have committed to pay.

Perhaps as important is understanding what is driving changes in payments being made to you. Regular communication with your customers to understand their financial situation is an underutilized tool to help guide strategies or incentives to assure payment. This insight will also be critical to enable you to plan ahead for impacts these accounts receivable variances will have on your accounts payable as well as help you effectively manage other obligations such as inventory requirements and labor.

Cash Balance Fluctuation

In stable times, forecasting can be a challenge. However, with the aforementioned factors affecting cash and the increased complexities of managing it such as rapid changes in access to loans like PPP and bank lines of credit, knowing the impact of today’s collections and disbursements on future cash balances can very quickly separate a stable business from a failed one.

Moving to a 13-week cash flow forecast dashboard that is updated weekly with status changes in payables, receivables, and loan balances will provide visibility and accuracy of your cash for an entire quarter and provide you with the time needed to adjust your costs and strategies accordingly before you run out of options

Few disagree that failure to effectively manage cash can lead an organization to fail more quickly than almost anything else. Greater diligence in tracking every aspect of it, especially under this unprecedented economic storm, is your greatest offense and time well invested.

By Jim Alessandro, Senior Consultant

RVR has helped numerous clients in the past with cash flow management. Please contact us if you are interested in discussing further.